At the end of each month, I post an update of my net worth,

including a brief discussion of any notable events that might have

occurred. The latest month's figures can

always be found under the Featured menu in the menu bar at the top of

the blog.

Last updated: End of October, 2018

Net Worth: $867,812

Change from last Month: -$45,658

My SQL courses on Udemy generated $53.57 of income. Not all that impressive. What is impressive however, is the fact that I now finally crossed the $11,000 lifetime income threshold! Sales have slowed over the past 3 months and I expect they will continue to stay low or drop further. As I talked about last month, this doesn't bother me.

My courses on SkillShare, meanwhile, earned $22.11. This is more of less in line with typical earnings. My courses have been on that platform now for a year. The highest month was $92.80 and the lowest (full) month was $9.88. The average monthly earnings works out to $34.16.

The decline was due to drops in two areas: the stock market and the housing market. The S&P 500 sunk by about 300 points this month. The index funds I'm invested in track the S&P 500, so that means losses for me. I'm looking at the S&P 500 drop as a buying opportunity. The end of the year is coming and that is when many index funds pay out dividends and capital gains. In fact, my fund of choice, SWPPX, only pays out once a year instead of quarterly, so I'm happy to accumulate as many shares as I can before the end of the year when its payout happens.

The housing market in the Seattle area has cooled off considerably as well, causing my home value to drop by about $20,000 from last month. The net result of these two things is a big drop in my net worth. It kinda sucks to see, but it pays to remember that financial figures rarely go up every single month. The important thing is to keep on saving and investing and the market will go back up again eventually.

Last month, I mentioned I was shutting down a self-directed IRA. That process is still continuing, which is why my cash balance remains high. Next month, the final step of moving the funds into a regular IRA should be complete. I was surprised that this has progressed as quick as it has. I had to file some paperwork with the state of Arizona to close my LLC and they said that process could take 50 business days - two and a half months! It turned out not to take that long at all - just 3 or 4 weeks. Now I have to wait for a closing bank statement showing the LLC's account is closed. That should be in the process of being generated today. Once I have that, I have to mail everything, including the funds, to the company managing the self-directed IRA, then initiate a rollover from them into my regular IRA at Schwab. None of this is complicated, but it does take time.

If you have any questions or suggestions for topics, please drop me a line in the comments section!

Last updated: End of October, 2018

Net Worth: $867,812

Change from last Month: -$45,658

Events Of Note Last Month:

My courses on SkillShare, meanwhile, earned $22.11. This is more of less in line with typical earnings. My courses have been on that platform now for a year. The highest month was $92.80 and the lowest (full) month was $9.88. The average monthly earnings works out to $34.16.

Net Worth Update

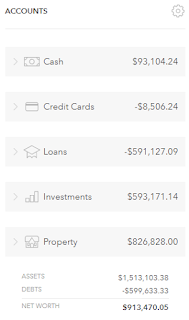

I normally wait until the month is completely finished before doing this post, but since the 31st falls on my normal publishing day this month, I'm going to publish this before the month technically ends. Truthfully, one more day won't make that much of a difference. Our net worth took a nose dive this month, dropping by $45,658. Ouch!

| |

| September 2018 | October 2018 |

The decline was due to drops in two areas: the stock market and the housing market. The S&P 500 sunk by about 300 points this month. The index funds I'm invested in track the S&P 500, so that means losses for me. I'm looking at the S&P 500 drop as a buying opportunity. The end of the year is coming and that is when many index funds pay out dividends and capital gains. In fact, my fund of choice, SWPPX, only pays out once a year instead of quarterly, so I'm happy to accumulate as many shares as I can before the end of the year when its payout happens.

The housing market in the Seattle area has cooled off considerably as well, causing my home value to drop by about $20,000 from last month. The net result of these two things is a big drop in my net worth. It kinda sucks to see, but it pays to remember that financial figures rarely go up every single month. The important thing is to keep on saving and investing and the market will go back up again eventually.

Last month, I mentioned I was shutting down a self-directed IRA. That process is still continuing, which is why my cash balance remains high. Next month, the final step of moving the funds into a regular IRA should be complete. I was surprised that this has progressed as quick as it has. I had to file some paperwork with the state of Arizona to close my LLC and they said that process could take 50 business days - two and a half months! It turned out not to take that long at all - just 3 or 4 weeks. Now I have to wait for a closing bank statement showing the LLC's account is closed. That should be in the process of being generated today. Once I have that, I have to mail everything, including the funds, to the company managing the self-directed IRA, then initiate a rollover from them into my regular IRA at Schwab. None of this is complicated, but it does take time.

If you have any questions or suggestions for topics, please drop me a line in the comments section!