Several years ago, I heard about an organization that wanted to help people start thinking long term - like really long term. The organization, The Long Now, was (and still is) doing this by building a clock that will run for 10,000 years. It ticks once per year and a cuckoo comes out once every 1,000 years. Making a physical clock that will last that long obviously has some huge challenges and to overcome them, engineers and designers are forced to think about how things can change over that long timespan. Once completed, the clock will be open to the public, hopefully instilling in them the same long-term thinking.

|

| The power mechanism for the clock |

Humans are notorious bad at thinking long term. We only live a century or less. Americans, I would argue, are even more fixated on the short term than Europeans. After all, our country is less than 250 years old. People have been living in Europe, however, for much longer than that. Many Europeans are reminded every day of the distant past when they see the remnants of those old civilizations around them today - the Colosseum of Rome, the Acropolis of Greece, the pyramids of Egypt (which, I know, isn't in Europe, but still makes my point).

In financial circles, long term thinking is virtually non-existent. Humans are typically loss-adverse - we would rather avoid losses than achieve gains.We monitor stock prices daily. If a stock we own drops, we feel the pain and many times will sell. As a result, we end up buying high and selling low, instead of the other way around. Studies have shown again and again that this is to our detriment. This study shows just how stupid that behavior is. It looked at the return of an S&P 500 index fund versus the performance of the average investor. The most amazing thing to emerge from this study is this fact:

Not a single investor in today's market practicing legitimate buy and hold in a low-cost index fund has ever lost money. Not one.

That is amazing. Let me repeat it.

Not a single investor in today's market practicing legitimate buy and hold in a low-cost index fund has ever lost money. Not one.

If you are a true buy and hold investor, you would have made money even if you bought at the worst times possible: at the top of the dotcom bubble in 2000, at the top of the market right before the 2007 crash, the day before 9/11. Even if you bought stock right before all those big crashes, as long as you held on and didn't sell, you'd still be ahead today.

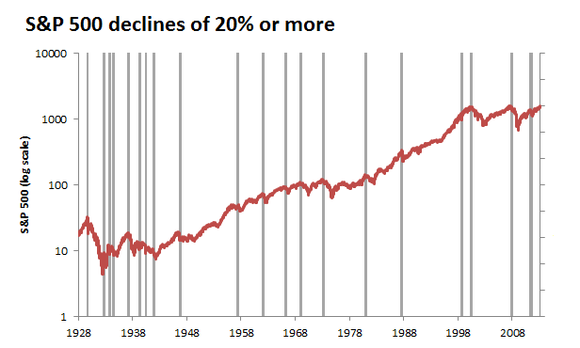

Market declines are normal. Since 1928, the S&P 500 has dropped by 20% or more 20 times. Yet, if you look at the long term picture, during that same time frame, the overall index increased 140-fold.

As an investor, I would LOVE to see my wealth increase 140-fold! But to get that, I would have had to have had the fortitude to stand seeing my investment drop in value by 20% or more almost two dozen times. Few investors today have that sort of moxie.

It's hard to blame them. Our news programs, politics, and society in general, revolve around crisis, outrage, and fear. (Fox is an entire network built on manufactured outrage and fear.) News programs jump to a new crisis as soon as the current one ends (or when people stop tuning in to hear stories about it). If the market drops 100 points, it's headlines on every news program and news website out there. Stories report on the billions of dollars that have been wiped out by the drop and you can't help but feel like you have lost huge sums of money as well. If you want to make money in the market, you need to be able to tune out all that crap. You have to take a long term view and realize drops happen. Recessions happen. You don't have to enjoy them, but you have to realize they are a part of life and the market will recover.

The Long Now Foundation also runs a site for long term bets called, appropriately enough, LongBets.org. Warren Buffett has a $1 million dollar bet on there with a hedge fund manger with the proceeds going to charity. Buffett has made the following bet: “Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.”

Clearly, Buffett is thinking long term and knows that trying to time the market is a losing game. I think every individual investor could benefit by adopting his outlook.

0 comments:

Post a Comment