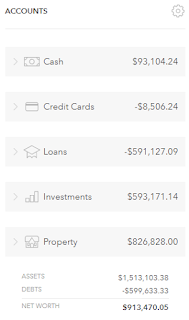

Last updated: End of September, 2018

Net Worth: $913,470

Change from last Month: +$848

Welcome To The New Monthly Update Page!

Now that I went out a bought my Tesla, I no longer have a goal to track progress towards. I could have started counting down until my car loan is paid off, but that's pretty boring. Also, that information will be reflected in my net worth number anyway, so I've decided this monthly post will just become a monthly net worth update.Events Of Note Last Month:

The biggest event, of course, was that I unlocked a new achievement:Woo hoo!!

In less exciting news, my SQL courses on Udemy generated $76.46 of income. My courses on SkillShare earned $25.58. As usual, this money went towards the Tesla. Last month, I was less than $100 away from hitting $11,000 in lifetime earnings on Udemy for my online courses. I came very close to crossing that milestone in September but I fell short by.... twenty one cents! Argh! Next month...

Truthfully, my online courses are getting a bit out of date. Not technically. Everything in my courses still applies and is valid. However, I made the courses using SQL Server 2012, which was the latest version at the time. Since they were made, SQL 2014, 2016, and 2017 have been released. The user interface has changed slightly, so I expect to start getting complaints from students that my course is teaching an old version. I'm not sure I care. It was a huge effort to make the courses and re-recording them just for a UI update doesn't seem worth the hassle.

Now that I have the Tesla, my motivation is lacking. I know I can still use the course income to pay down my loan, but.... meh. There are some new features I can make new courses about, but I don't have the setup to demonstrate those on my laptop. So, I expect my course income to start dwindling off soon.

Net Worth Update

Surprisingly, our net worth rose again, this month by $848 to another all time high of $913,470. I really wasn't expecting this.

|  |

| August 2018 | September 2018 |

The gain would have likely been higher, but Tesla stock is down $43 as I write this because the SEC just filed a lawsuit against Elon Musk for his tweets about taking the company private. One of the terms they are asking for is that Musk no longer be allowed to serve as an officer or director of any publicly traded company. I think Musk was stupid to tweet what he did, but that penalty seems a bit harsh. We'll see how this plays out.

Lots of numbers jumping around this month.

Our cash balance is really high because I'm in the middle of exiting a real estate investment. I had $70,000 in a self-directed IRA that was invested in a hard money loan (i.e., I was a mortgage lender). That mortgage was paid off and my partner has been having some difficulties finding new investments, so I've decided to roll that investment back into an IRA at a traditional brokerage. The self-directed IRA is nice, but the company that manages it is fairly expensive. If I can't get an 8% or higher return, it's not worth the hassle for me.

And it is a hassle. A self-directed IRA requires an LLC and mine was formed in Arizona, where I no longer live. The bank account for the LLC was also in Arizona. I can't open a business bank account in Washington unless the LLC is registered in Washington, which costs a couple hundred dollars to do. So rather than move all that stuff here only to get mediocre returns with my partner, I'm just going to close the LLC and move the IRA back into the stock market. Unfortunately, officially closing the LLC requires filing paperwork with the state of Arizona and they say that process can take up to 50 business days. That's two and a half months for filing a single piece of paper! Anyway, the upshot of all this is that my $70,000 is sitting in a savings account until that process is finished, so my cash number will be inflated for a while. When all is said and done, that money will eventually find a home in the Investments category.

Similarly, I had a hard money loan investment in my daughter's name and I also moved that into the stock market.

Those two investments were formerly part of the Property category, due to how Mint.com handles manual account entries.

On the other hand, the Property category now also includes my Tesla, the value of which is somewhat offset by my new auto loan which shows in the Loan category.

So just looking at the numbers provides a somewhat blurry image of how my net worth is actually composed this month, but the final number is the one that really matters. And that went up, so all is good!

If you have any questions or suggestions for topics, please drop me a line in the comments section!

No comments:

Post a Comment